Mutual Funds investing via SIP is one the best wealth creation tool but only and if you remain invested during turbulent times of stock market. I am personally a big fan of mutual funds because it is has always given me superior returns. It is not just that i only give recommendation but i do remain invested in this scheme.

I have selected on 3 funds rather than 10 -15 funds which actually confuse the investor i mean lesser the better

Below are the 3 best equity mutual funds (Large Cap) as on 30/05/2016 handpicked for you which are based on following parameters

1-> Funds having CRISIL ratings of 4 Star & 5 Star

2-> Funds having Value Research Ratings of 4 Star & 5 Star

3-> Superior returns compared to benchmark funds for last 10 years (where available) in SIP & Lump Sum investment (Proof below)

4-> Funds with positive Alpha

5-> Funds providing a return of more than 12% CAGR

Must Read : Why Real Estate is and always was a Dull Investment

#1 : SBI Bluechip Fund

Objective of the fund is to provide long term wealth while investing more than 80% in Equity & 20% in Debt related instruments

Materials and Industrial are some places fund is currently overweight compared to index.Fund Manager has taken that little bit of a contra approach in the sense where the other fund would probably be more towards financial and technology companies

SBI Bluechip Fund has outperformed its benchmark index BSE 100 Indices from last 10 years

From the above screen we can analyze

#2 : Birla Sun Life Frontline Equity

If I had to look at the consistency of returns; over the last 10 years it is been a quartile one or two performer throughout. So an investor like you getting into this fund would be very comfortable about the consistent track record of returns.

Let us take a closer look at the fund returns compared to Benchmark Index NIFTY 50

#3 : ICICI Prudential Top 100 Fund

ICICI Prudential Top 100 contains a slightly different large-cap strategy that is aggressive in comparison to different funds from the AMC’s however what i might call it a contra strategy on the large-cap side. Therefore where as the portfolio would be holding regular sectors, the fund manager is truly at now overweight in sectors like materials, industrial and energy, which is what this fund is making an attempt to derive value from.

Let us have a closer look at the returns from Top 100 Fund

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

Mutual Funds & Insurance Related Articles :-

Benefits of Systematic Investment Plan

What is Systematic Transfer Plan and How it works ?

Advantages of Equity Linked Savings Schemes

Top 3 Mutual Funds to Invest in 2016 for Long Term

How Much Insurance Do I Need ?

How to Select Mutual Fund for Portfolio ?

How to Budget your money with 40/30/30 Rule ?

Mutual Fund Versus ULIP

Why Term Insurance Policy is required till 60 years ?

In case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

I have selected on 3 funds rather than 10 -15 funds which actually confuse the investor i mean lesser the better

Below are the 3 best equity mutual funds (Large Cap) as on 30/05/2016 handpicked for you which are based on following parameters

1-> Funds having CRISIL ratings of 4 Star & 5 Star

2-> Funds having Value Research Ratings of 4 Star & 5 Star

3-> Superior returns compared to benchmark funds for last 10 years (where available) in SIP & Lump Sum investment (Proof below)

4-> Funds with positive Alpha

5-> Funds providing a return of more than 12% CAGR

Must Read : Why Real Estate is and always was a Dull Investment

#1 : SBI Bluechip Fund

Objective of the fund is to provide long term wealth while investing more than 80% in Equity & 20% in Debt related instruments

Materials and Industrial are some places fund is currently overweight compared to index.Fund Manager has taken that little bit of a contra approach in the sense where the other fund would probably be more towards financial and technology companies

SBI Bluechip Fund has outperformed its benchmark index BSE 100 Indices from last 10 years

| ||||

| Image Source : freefincalc.com |

- If you had invested Rs 1000 in SIP for last 10 years then you would have accumulated Rs 245940 for an investment of Rs 120000 with a Compounded Annual Growth Rate (CAGR) of 13.8% and absolute return of 104.5% double the amount with a mere Rs 1000 a Month

- Compared to Benchmark Index of BSE 100 your SIP invested value would be Rs 190269 vis a vis Rs 245940 generated from fund

- Year after Year SBI Bluechip Fund has outperformed BSE 100 Benchmark

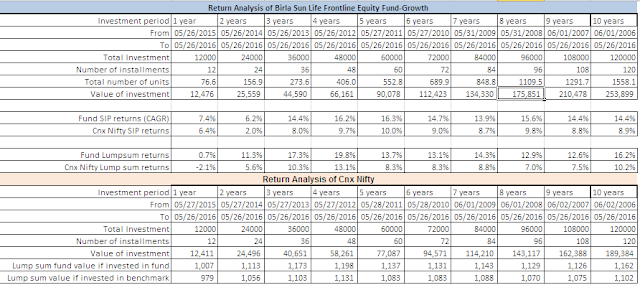

#2 : Birla Sun Life Frontline Equity

If I had to look at the consistency of returns; over the last 10 years it is been a quartile one or two performer throughout. So an investor like you getting into this fund would be very comfortable about the consistent track record of returns.

Let us take a closer look at the fund returns compared to Benchmark Index NIFTY 50

|

| Image Source : freefincalc.com |

- If you had invested Rs 1000 in SIP for last 10 years then you accumulated wealth would Rs 253899 for an investment of Rs 120000 with a Compounded Annual Growth Rate (CAGR) of 14.4% and absolute return of 111.5825% infact double the amount with a mere Rs 1000 a Month

- Compared to Benchmark Index of Nifty 50 your SIP invested value would be Rs 189384 vis a vis Rs 253899 generated from fund

- Year after Year Birla SL Frontline Equity Fund has outperformed Nifty 50

#3 : ICICI Prudential Top 100 Fund

ICICI Prudential Top 100 contains a slightly different large-cap strategy that is aggressive in comparison to different funds from the AMC’s however what i might call it a contra strategy on the large-cap side. Therefore where as the portfolio would be holding regular sectors, the fund manager is truly at now overweight in sectors like materials, industrial and energy, which is what this fund is making an attempt to derive value from.

Let us have a closer look at the returns from Top 100 Fund

|

| Image Source : freefincalc.com |

- If you had invested Rs 1000 in SIP for last 10 years then you accumulated wealth would Rs 233661 for an investment of Rs 120000 with a Compounded Annual Growth Rate (CAGR) of 12.8% and absolute return of 94.7175% almost double the amount with a mere Rs 1000 a Month

- Compared to Benchmark Index of Nifty 50 your SIP invested value would be Rs 18984 vis a vis Rs 233661 generated from fund

- Year after Year ICICI Top 100 Fund has outperformed Nifty 50

except the current year but i truly believe it is a fund for long term investment

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

Mutual Funds & Insurance Related Articles :-

Benefits of Systematic Investment Plan

What is Systematic Transfer Plan and How it works ?

Advantages of Equity Linked Savings Schemes

Top 3 Mutual Funds to Invest in 2016 for Long Term

How Much Insurance Do I Need ?

How to Select Mutual Fund for Portfolio ?

How to Budget your money with 40/30/30 Rule ?

Mutual Fund Versus ULIP

Why Term Insurance Policy is required till 60 years ?

Equities related article :

What is Power of Attorney in Online Trading?

Futures & Options related article :

Bull Put SpreadIn case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

The Article is only for information purposes and Vipul Shah (https://investkiyakya.blogspot.com)

is not providing any professional/investment advice through it. The

article does not constitute or is not intended to constitute an offer to

buy or sell, or a solicitation to an offer to buy or sell financial

products, units or securities. https://investkiyakya.blogspot.com disclaims

warranty of any kind, whether express or implied, as to any

matter/content contained in this article, including without limitation

the implied warranties of merchantability and fitness for a particular

purpose. https://investkiyakya.blogspot.com and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the contents of this guide. Use of this article is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. https://investkiyakya.blogspot.com does

not warrant completeness or accuracy of any information published in

this guide. All intellectual property rights emerging from this article

are and shall remain with https://investkiyakya.blogspot.com.

This article is for your personal use and you shall not resell, copy,

or redistribute this article , or use it for any commercial purpose. All

names and situations depicted in the article are purely fictional and

serve the purpose of illustration only. Any resemblance between the

illustrations and any persons living or dead is purely coincidental.