Mutual Funds Vs Real Estate is a very interesting question that seems to haunt most of the 20+ and 30+ somethings (including yours truly). My answer to your question is both.

Real Estate is seriously long term where your minimum term may be around 10-20 years before you make some serious money of it. Only in a very specific cases, there is appreciation in short term, but that's a minority. If you are talking about serious money, then you need to bide your time.

One rejoinder to the above point is that when we talk of Real Estate, we should be talking of investment and not the appreciation that the flat (where one resides) undergoes. That's paper money and can't/shouldn't be liquidated. What good is a investment if one doesn't have a roof over the head?

MF is good in short, medium and long term. The advantage of MF is it's adaptability (it's not easy to sell one site and buy another as compared to selling one MF and buying another), Liquidity and ease of operation.

Since whether to invest in mutual funds or real estate was daunting me also I wanted to write about it from a long time and 2 things suddenly happened in a week which made me write this post , first, one of my reader suggested to me to write an article on mutual funds vs real estate and second is i wanted to change the perception of investors that real estate is best investment which i realized after having conversation with one of my friend.

If you’re in your twenties or thirties, it makes more sense to invest in equity or balanced mutual funds instead. Not convinced? Here’s why.

So here is what happened in last week of month of June 2016 which made me write this post.

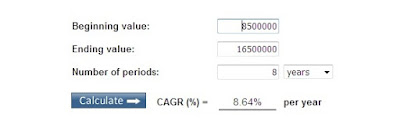

One of my close friend staying in my locality in western Suburbs of Mumbai named Borivali West(It could be any locality the pick one and compared it with MF) ,was discussing how he purchased his 2BHK (985 Sq Ft) flat at Rs 85 Lakhs (78 Lakhs Price + 7 Lakhs Including Stamp Duty, Registration fees, brokerage etc) way back in 2008 and the best part (according to him) was "His flat is now worth Rs 1.65 Cr and his investment has given him double the returns in 8 years".

You will find many idiots like him who simply calculates the returns on point to point basis and not in terms of CAGR. If you calculate the returns in CAGR it is hardly 8.64%.(see image above)

Must Read : Top 3 Large Cap Fund to Invest in 2016 via SIP

After the explanation of CAGR, he was surprised to see that in terms of returns it is very less but still he stood on his argument. On further digging i came to know that he took a home loan of Rs 45 lakhs and paid Rs 40 lakhs from his savings in order to buy his home.

It was the home in which he was staying so by no means it can be considered as an investment.

We both literally went into a tussle to prove our point,

He was of the opinion that Investing in Real Estate Vs Mutual Fund was better and i was of the opinion that investing in Mutual Funds Vs Real Estate was better.

With all facts and figures on tables finally i won the argument which is listed below which was an eye opener for me and it may be for you.

The above images shows the price trends in Borivali West locality in Mumbai from Jan-Mar 2008 till Apr-Jun 2016.

In the first image prices were hovering around 8000 Rs per Sq feet in 2008 and in 2016 it is near about 18000 per Sq Ft.

Below is the interest calculation for home loan of Rs 45 Lakhs at 10.5%

Real Estate is seriously long term where your minimum term may be around 10-20 years before you make some serious money of it. Only in a very specific cases, there is appreciation in short term, but that's a minority. If you are talking about serious money, then you need to bide your time.

One rejoinder to the above point is that when we talk of Real Estate, we should be talking of investment and not the appreciation that the flat (where one resides) undergoes. That's paper money and can't/shouldn't be liquidated. What good is a investment if one doesn't have a roof over the head?

MF is good in short, medium and long term. The advantage of MF is it's adaptability (it's not easy to sell one site and buy another as compared to selling one MF and buying another), Liquidity and ease of operation.

Since whether to invest in mutual funds or real estate was daunting me also I wanted to write about it from a long time and 2 things suddenly happened in a week which made me write this post , first, one of my reader suggested to me to write an article on mutual funds vs real estate and second is i wanted to change the perception of investors that real estate is best investment which i realized after having conversation with one of my friend.

If you’re in your twenties or thirties, it makes more sense to invest in equity or balanced mutual funds instead. Not convinced? Here’s why.

So here is what happened in last week of month of June 2016 which made me write this post.

One of my close friend staying in my locality in western Suburbs of Mumbai named Borivali West(It could be any locality the pick one and compared it with MF) ,was discussing how he purchased his 2BHK (985 Sq Ft) flat at Rs 85 Lakhs (78 Lakhs Price + 7 Lakhs Including Stamp Duty, Registration fees, brokerage etc) way back in 2008 and the best part (according to him) was "His flat is now worth Rs 1.65 Cr and his investment has given him double the returns in 8 years".

You will find many idiots like him who simply calculates the returns on point to point basis and not in terms of CAGR. If you calculate the returns in CAGR it is hardly 8.64%.(see image above)

Must Read : Top 3 Large Cap Fund to Invest in 2016 via SIP

After the explanation of CAGR, he was surprised to see that in terms of returns it is very less but still he stood on his argument. On further digging i came to know that he took a home loan of Rs 45 lakhs and paid Rs 40 lakhs from his savings in order to buy his home.

It was the home in which he was staying so by no means it can be considered as an investment.

We both literally went into a tussle to prove our point,

He was of the opinion that Investing in Real Estate Vs Mutual Fund was better and i was of the opinion that investing in Mutual Funds Vs Real Estate was better.

With all facts and figures on tables finally i won the argument which is listed below which was an eye opener for me and it may be for you.

|

| Source : magicbricks.com |

|

| Source : Magicbricks.com |

The above images shows the price trends in Borivali West locality in Mumbai from Jan-Mar 2008 till Apr-Jun 2016.

In the first image prices were hovering around 8000 Rs per Sq feet in 2008 and in 2016 it is near about 18000 per Sq Ft.

Below is the interest calculation for home loan of Rs 45 Lakhs at 10.5%

As on Jul 2016 his outstanding loan is 35,78,000 and he got tax exemption of 2,00,000 from Interest which can be claimed as a deduction under Section 24 (Rs. 150000/- up to A.Y. 2014-15).

Since I selected Equity Linked Savings Funds the interest which he claimed in Section 24 does not have an impact in my MF calculation , this is the only area where he gets an upper hand.

Must Read : Best 3 Midcap Churning Money For Investors

Must Read : Best 3 Midcap Churning Money For Investors

Since he had 40 Lakhs as his investment at the time of purchasing the home it was decided to transfer the amount in Birla Sunlife Cash Plus liquid fund and a STP amount of Rs 40000 to Birla Sun Life Tax Plan. (I would have selected Axis Long Term Equity ELSS fund but in order to create a realistic scenario BSL Tax Plan was taken as it has given moderate returns.)

Transferor Scheme : Birla Sun Life Cash Plus - Growth

Transferee Scheme : Birla Sun Life Tax Plan - Growth Option

One Time Invested Amount : Rs 40 Lakhs

STP First Date : 25th of every month from 25-03-2008 till 17/07/2016

Transfer Amount : Rs 40000

Calculations are shown in the image below

By Investing Rs 40 Lakhs in 2008 in STP your money would have grown to Rs 99.37 Lakhs in 2016 at a CAGR of 12.05%

On the other hand since he had a loan of Rs 45 Lakhs and an EMI of Rs 40000 it was suggested that he remain invested via SIP in Large Cap fund of HDFC Top 200 for Rs 40000 a month. The reason for selection of HDFC Top 200 is because it was one the best fund recommended by most of the MF distributors.

SIP of Rs 40000 invested from 25-03-2008 till today date would have grown to 73.39 Lakhs compared to an investment of Rs 40 Lakhs

So lets do the maths now

STP one time investment : Rs 40 Lakhs

SIP Invested amount : Rs 40 Lakhs

Total : Rs 80 Lakhs

STP amount as on 17/07/2016 : Rs 99.37 Lakhs

SIP Amount as on 17/07/2016 : Rs 73.40 Lakhs

Total : 1 Crore & 72 Lakhs

Wealth generated from these 8 years would be enough to buy an apartment in our area (may be in your area) and

the best part is without any home loan.

Still my friend is paying outstanding home loan of Rs 35.78 Lakhs with interest.

We middle class people end up paying home loan for 20 years,at the end of our life all we have is a just a home and then again an educational loan for our children.

We should have enough money that bank should come to us for deposits rather we going to bank for loans

Must Read : Best ELSS Tax Savings Funds to Invest in India in 2016 for Long Term

About the author

Vipul is a software sales professional for Asset Management Companies, Pension Fund and Stock Brokers from last 16 years.

Vipul believes that the amount of financial information flowing our way is probably 10 times more than what it used to be 15 to 20 years back due to the advent of newer forms of communication.

All this information is creating an information overload in the minds of individuals resulting in analysis paralysis and he helps them select the right decision while creating a Goal based financial plan.

In case if you need a Financial Plan please connect to him on vipuls1979@gmail.com

SIP of Rs 40000 invested from 25-03-2008 till today date would have grown to 73.39 Lakhs compared to an investment of Rs 40 Lakhs

So lets do the maths now

STP one time investment : Rs 40 Lakhs

SIP Invested amount : Rs 40 Lakhs

Total : Rs 80 Lakhs

STP amount as on 17/07/2016 : Rs 99.37 Lakhs

SIP Amount as on 17/07/2016 : Rs 73.40 Lakhs

Total : 1 Crore & 72 Lakhs

Wealth generated from these 8 years would be enough to buy an apartment in our area (may be in your area) and

the best part is without any home loan.

Still my friend is paying outstanding home loan of Rs 35.78 Lakhs with interest.

We middle class people end up paying home loan for 20 years,at the end of our life all we have is a just a home and then again an educational loan for our children.

We should have enough money that bank should come to us for deposits rather we going to bank for loans

Must Read : Best ELSS Tax Savings Funds to Invest in India in 2016 for Long Term

But you will save you have never heard of anyone who became a millionaire by investing in equity funds.

Because

mutual fund NAVs are available to you on a daily basis, there’s a

temptation to over-trade. Most people who haven’t made money on equity

funds are those who haven’t stayed on for ten years or more. They’ve

bought funds, sold them and bought them again trying to time markets.

If you did the same with property investments (they have cycles too)

you would lose money. Even long-term investors in equity funds invest

too little in them.

IN A NUTSHELL

It is now knownn that the Indian property market attracts a lot of cash money and with the government's new anti-black money initiatives in place, the property market is going to be further impacted. This makes investing in financial assets such as mutual funds increasingly attractive; not only can you invest with maximum convenience (sitting at your computer and hitting a few keys to initiate the investment), mutual funds have the potential to offer attractive investment returns thereby helping you build your wealth.

Apart from the above, once you sign up for a home loan, you can’t vary your EMI or stop paying it, if the property doesn’t appreciate or if you quit your job.

Apart from the above, once you sign up for a home loan, you can’t vary your EMI or stop paying it, if the property doesn’t appreciate or if you quit your job.

With an SIP, you can redeem them in an emergency.

Buying a home for the first time or investment in real estate is truly a personal choice.

Awaiting for your comments my friends

About the author

Vipul is a software sales professional for Asset Management Companies, Pension Fund and Stock Brokers from last 16 years.

Vipul believes that the amount of financial information flowing our way is probably 10 times more than what it used to be 15 to 20 years back due to the advent of newer forms of communication.

All this information is creating an information overload in the minds of individuals resulting in analysis paralysis and he helps them select the right decision while creating a Goal based financial plan.

In case if you need a Financial Plan please connect to him on vipuls1979@gmail.com

Mutual Funds & Insurance Related Articles :-

Benefits of SIP

What is SWP in mutual Funds

Best 3 Large Cap Mutual Funds for SIP in 2016

Best 3 Midcap Mutual Funds for SIP in 2016

Best ELSS Tax Savings Mutual Funds for SIP in 2016

Why you should not buy ULIP

How to Select Mutual Fund for Portfolio

Liquid Funds are better alternative than Savings Bank account

What is FMP in Mutual Funds

Complete Guide on Monthly Income Plans

Complete Guide on Credit Opportunities Fund

How to Save Tax using Equity Linked Savings Scheme

How to Budget Your Money

How Much Insurance Do You Really Need

Why Should you buy Term Insurance Upto 60 Years

5 Must Have Insurance Policies for Women

Disclaimer :-

Benefits of SIP

What is SWP in mutual Funds

Best 3 Large Cap Mutual Funds for SIP in 2016

Best 3 Midcap Mutual Funds for SIP in 2016

Best ELSS Tax Savings Mutual Funds for SIP in 2016

Why you should not buy ULIP

How to Select Mutual Fund for Portfolio

Liquid Funds are better alternative than Savings Bank account

What is FMP in Mutual Funds

Complete Guide on Monthly Income Plans

Complete Guide on Credit Opportunities Fund

How to Save Tax using Equity Linked Savings Scheme

How to Budget Your Money

How Much Insurance Do You Really Need

Why Should you buy Term Insurance Upto 60 Years

5 Must Have Insurance Policies for Women

Disclaimer :-

The Article is only for information purposes and Vipul Shah (https://investkiyakya.blogspot.com)

is not providing any professional/investment advice through it. The

article does not constitute or is not intended to constitute an offer to

buy or sell, or a solicitation to an offer to buy or sell financial

products, units or securities. https://investkiyakya.blogspot.com disclaims

warranty of any kind, whether express or implied, as to any

matter/content contained in this article, including without limitation

the implied warranties of merchantability and fitness for a particular

purpose. https://investkiyakya.blogspot.com and

its subsidiaries / affiliates / sponsors / trustee or their officers,

employees, personnel, directors will not be responsible for any

direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the contents of this guide. Use of this article is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. https://investkiyakya.blogspot.com does

not warrant completeness or accuracy of any information published in

this guide. All intellectual property rights emerging from this article

are and shall remain with https://investkiyakya.blogspot.com.

This article is for your personal use and you shall not resell, copy,

or redistribute this article , or use it for any commercial purpose. All

names and situations depicted in the article are purely fictional and

serve the purpose of illustration only. Any resemblance between the

illustrations and any persons living or dead is purely coincidental.

I am extremely impressed thanks for sharing all information. It is a great post for the people to get the proper information.

ReplyDeletestock advisory tips

This blog gives best examples for traders to understand.

ReplyDeleteStock tips

Excellent!! This One Blog Is Awesome, thanks for sharing this impotent Information Mutual Funds

ReplyDeleteboth of investment method is good, it depends on how much money you want to spend. I have gone through your overall blog and seems very nice to check it out. really explains everything in detail, the article is very interesting and effective. Thank you and good luck with the upcoming articles. if you have any further queries relating to investing in property please visit Icon Accounting>

ReplyDeleteBoth methods of investment are fine; it all depends on how much money you want to spend. I went over your entire blog and it appears to be pretty wonderful to check out. The post is highly fascinating and effective since it describes everything in depth. Thank you, and best wishes for the next pieces. I am sharing a details about Gaur World Smartstreet

ReplyDeleteGaur World Smart Street is set to become one of Greater Noida West's most famous retail and commercial destinations. This bustling centre, just 2.5 kilometers from Gaur City, is home to a vast emporium entirely dedicated to retail brands, shopping complexes, kiosks, food courts, and office spaces, where brands and enterprises may achieve exceptional success.

thanks for sharing with us.very interesting blog.........

ReplyDeleteApex Park Square is a fantastic option for a site investment. VIABLE VENTURE PVT. LTD. and Apex Floral Group created Apex Site Square. Its world-class construction expands the economic horizons of the Noida expansion area. The Apex Square Site Plan and Specifications are simple to comprehend, with a few key features such as being located in a prime location with over 2 million people living nearby, being a projected metro hub, and having easy access to the National Highway, among others.

BUY COMMERCIAL SPACE AT APEX PARK SQUARE GREATER NOIDA WEST

thanks for sharing an interesting blog with us.....

ReplyDeleteGaur Yamuna City is India's largest group-housing development, with a location on the Yamuna Expressway, one of the country's fastest-growing professional hubs. The gated township, which places a strong emphasis on the environment and sustainable living, offers an enviable mix of state-of-the-art residential, business, retail, and hospitality development. GYC promises peace and serenity while providing world-class amenities in one of the country's most vibrant and fastest expanding destinations, just minutes from the Formula One track.

Buy Commercial Space for Investment in Gaur Yamuna City Noida

The master real estate agents can help you when you are buying property or home in

ReplyDeletelahore smart city. So visit themrl.com and find the best agent for yourself.