Mutual Funds investing via SIP is one the best wealth creation tool but only and if you remain invested during turbulent times of stock market. I am personally a big fan of mutual funds because it is has always given me superior returns. It is not just that i only give recommendation but i do remain invested in this scheme.

I have selected on 3 funds rather than 10 -15 funds which actually confuse the investor i mean lesser the better

Below are the 3 best equity mutual funds (Large Cap) as on 30/05/2016 handpicked for you which are based on following parameters

1-> Funds having CRISIL ratings of 4 Star & 5 Star

2-> Funds having Value Research Ratings of 4 Star & 5 Star

3-> Superior returns compared to benchmark funds for last 10 years (where available) in SIP & Lump Sum investment (Proof below)

4-> Funds with positive Alpha

5-> Funds providing a return of more than 12% CAGR

Must Read : Why Real Estate is and always was a Dull Investment

#1 : SBI Bluechip Fund

Objective of the fund is to provide long term wealth while investing more than 80% in Equity & 20% in Debt related instruments

Materials and Industrial are some places fund is currently overweight compared to index.Fund Manager has taken that little bit of a contra approach in the sense where the other fund would probably be more towards financial and technology companies

SBI Bluechip Fund has outperformed its benchmark index BSE 100 Indices from last 10 years

From the above screen we can analyze

#2 : Birla Sun Life Frontline Equity

If I had to look at the consistency of returns; over the last 10 years it is been a quartile one or two performer throughout. So an investor like you getting into this fund would be very comfortable about the consistent track record of returns.

Let us take a closer look at the fund returns compared to Benchmark Index NIFTY 50

#3 : ICICI Prudential Top 100 Fund

ICICI Prudential Top 100 contains a slightly different large-cap strategy that is aggressive in comparison to different funds from the AMC’s however what i might call it a contra strategy on the large-cap side. Therefore where as the portfolio would be holding regular sectors, the fund manager is truly at now overweight in sectors like materials, industrial and energy, which is what this fund is making an attempt to derive value from.

Let us have a closer look at the returns from Top 100 Fund

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

Mutual Funds & Insurance Related Articles :-

Benefits of Systematic Investment Plan

What is Systematic Transfer Plan and How it works ?

Advantages of Equity Linked Savings Schemes

Top 3 Mutual Funds to Invest in 2016 for Long Term

How Much Insurance Do I Need ?

How to Select Mutual Fund for Portfolio ?

How to Budget your money with 40/30/30 Rule ?

Mutual Fund Versus ULIP

Why Term Insurance Policy is required till 60 years ?

In case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

I have selected on 3 funds rather than 10 -15 funds which actually confuse the investor i mean lesser the better

Below are the 3 best equity mutual funds (Large Cap) as on 30/05/2016 handpicked for you which are based on following parameters

1-> Funds having CRISIL ratings of 4 Star & 5 Star

2-> Funds having Value Research Ratings of 4 Star & 5 Star

3-> Superior returns compared to benchmark funds for last 10 years (where available) in SIP & Lump Sum investment (Proof below)

4-> Funds with positive Alpha

5-> Funds providing a return of more than 12% CAGR

Must Read : Why Real Estate is and always was a Dull Investment

#1 : SBI Bluechip Fund

Objective of the fund is to provide long term wealth while investing more than 80% in Equity & 20% in Debt related instruments

Materials and Industrial are some places fund is currently overweight compared to index.Fund Manager has taken that little bit of a contra approach in the sense where the other fund would probably be more towards financial and technology companies

SBI Bluechip Fund has outperformed its benchmark index BSE 100 Indices from last 10 years

| ||||

| Image Source : freefincalc.com |

- If you had invested Rs 1000 in SIP for last 10 years then you would have accumulated Rs 245940 for an investment of Rs 120000 with a Compounded Annual Growth Rate (CAGR) of 13.8% and absolute return of 104.5% double the amount with a mere Rs 1000 a Month

- Compared to Benchmark Index of BSE 100 your SIP invested value would be Rs 190269 vis a vis Rs 245940 generated from fund

- Year after Year SBI Bluechip Fund has outperformed BSE 100 Benchmark

#2 : Birla Sun Life Frontline Equity

If I had to look at the consistency of returns; over the last 10 years it is been a quartile one or two performer throughout. So an investor like you getting into this fund would be very comfortable about the consistent track record of returns.

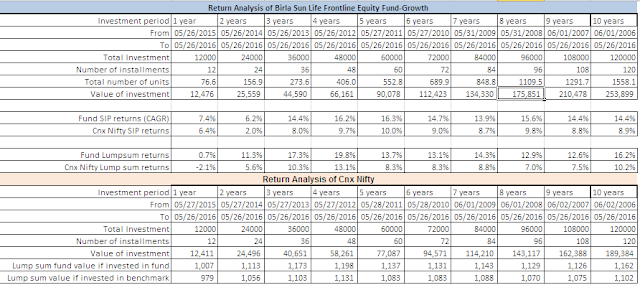

Let us take a closer look at the fund returns compared to Benchmark Index NIFTY 50

|

| Image Source : freefincalc.com |

- If you had invested Rs 1000 in SIP for last 10 years then you accumulated wealth would Rs 253899 for an investment of Rs 120000 with a Compounded Annual Growth Rate (CAGR) of 14.4% and absolute return of 111.5825% infact double the amount with a mere Rs 1000 a Month

- Compared to Benchmark Index of Nifty 50 your SIP invested value would be Rs 189384 vis a vis Rs 253899 generated from fund

- Year after Year Birla SL Frontline Equity Fund has outperformed Nifty 50

#3 : ICICI Prudential Top 100 Fund

ICICI Prudential Top 100 contains a slightly different large-cap strategy that is aggressive in comparison to different funds from the AMC’s however what i might call it a contra strategy on the large-cap side. Therefore where as the portfolio would be holding regular sectors, the fund manager is truly at now overweight in sectors like materials, industrial and energy, which is what this fund is making an attempt to derive value from.

Let us have a closer look at the returns from Top 100 Fund

|

| Image Source : freefincalc.com |

- If you had invested Rs 1000 in SIP for last 10 years then you accumulated wealth would Rs 233661 for an investment of Rs 120000 with a Compounded Annual Growth Rate (CAGR) of 12.8% and absolute return of 94.7175% almost double the amount with a mere Rs 1000 a Month

- Compared to Benchmark Index of Nifty 50 your SIP invested value would be Rs 18984 vis a vis Rs 233661 generated from fund

- Year after Year ICICI Top 100 Fund has outperformed Nifty 50

except the current year but i truly believe it is a fund for long term investment

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

Mutual Funds & Insurance Related Articles :-

Benefits of Systematic Investment Plan

What is Systematic Transfer Plan and How it works ?

Advantages of Equity Linked Savings Schemes

Top 3 Mutual Funds to Invest in 2016 for Long Term

How Much Insurance Do I Need ?

How to Select Mutual Fund for Portfolio ?

How to Budget your money with 40/30/30 Rule ?

Mutual Fund Versus ULIP

Why Term Insurance Policy is required till 60 years ?

Equities related article :

What is Power of Attorney in Online Trading?

Futures & Options related article :

Bull Put SpreadIn case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

The Article is only for information purposes and Vipul Shah (https://investkiyakya.blogspot.com)

is not providing any professional/investment advice through it. The

article does not constitute or is not intended to constitute an offer to

buy or sell, or a solicitation to an offer to buy or sell financial

products, units or securities. https://investkiyakya.blogspot.com disclaims

warranty of any kind, whether express or implied, as to any

matter/content contained in this article, including without limitation

the implied warranties of merchantability and fitness for a particular

purpose. https://investkiyakya.blogspot.com and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the contents of this guide. Use of this article is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. https://investkiyakya.blogspot.com does

not warrant completeness or accuracy of any information published in

this guide. All intellectual property rights emerging from this article

are and shall remain with https://investkiyakya.blogspot.com.

This article is for your personal use and you shall not resell, copy,

or redistribute this article , or use it for any commercial purpose. All

names and situations depicted in the article are purely fictional and

serve the purpose of illustration only. Any resemblance between the

illustrations and any persons living or dead is purely coincidental.

Thank you for sharing this amazing information.

ReplyDeleteThis is where I also found Mutual Funds in Pakistan 2019 very well explained.

Thanks for this information really appreciate

ReplyDeleteMcx tips

For such an informative article its really nice portraying things on risk basis. Here some basics that will be helpful for SIP and mutual funds beginners. SIP – THINGS YOU SHOULD KNOW ABOUT BEFORE START INVESTING

ReplyDeleteTo invest your money, a mutual fund is the best option for you to make money. It will be easy to invest and you could have many benefits by investing your money in Mutual funds.

ReplyDeletehow to invest in mutual funds

A mutual fund is one of the best options for small investors. you could earn more money by spending less amount. you could get many benefits through investing your money in mutual funds.

ReplyDeletehow to invest in mutual funds

Thanks for writing this amazing article, I would love it if you also write about Mutual Funds in Pakistan and Investments in Pakistan

ReplyDeleteRamadan is the period for Muslims to show identity and to be one with those in need who are suffering. During this holy. A Perfect Chance to Donate Charity

ReplyDeleteDonate Zakat to Muslims charity through Ummah Charity International to help Muslim.

ReplyDeleteThank you for such a fantastic blog. Where else could anyone get that kind of info written in such a perfect way. Thanks

ReplyDeletestock advisory tips

Zee Entertainment, Bajaj Finance, Bajaj Finserv, Hero Motocorp and Maruti Suzuki were among major gainers on the Nifty, while losers include Yes Bank, Dr Reddy Labs, Vedanta, Hindalco and Infosys.

ReplyDeleteequitytips

Thank you for sharing, it's great: Dịch thuật Hà Nội, Dịch thuật TPHCM, Dịch thuật Bắc Ninh, Dịch thuật Thanh Hóa, Dịch thuật Cần Thơ, Dịch thuật Hải Phòng, Dịch thuật Đà Nẵng, Dịch thuật Nghệ An, Dịch thuật Bình Dương,.....

ReplyDeleteIf you are planning to apply for Mutual Fund online, then you need to do the following things. You need first to identify the purpose of investing, then get an idea about KYC, avail details about schemes, and know risk factors. The best mutual funds are available in Axis bank as the bank got best Mutual fund plans. All mutual fund that is available in Axis bank are giving out best returns after the completion of the period for which you have invested. The bank has got different kinds of MF, which, include the retirement funds, equity funds, income funds, balanced funds, specialty funds, and other funds too. So, when you are planning hard about this, all make sure which fund is best for you and how the fund is giving you benefits after the investment period is over for you. Check all the factors before investing in any mutual funds.

ReplyDeleteGood information... A mutual fund is one of the best financial products which can lead you to make money and get more returns.

ReplyDeleteBest financial advisors in Chennai

Financial planners in Chennai

Investment advisor in Chennai

Financial planner near me

Digital Marketing Blogs

ReplyDeleteTechnology Blogs

Insurance Tips

Seo Tips

Seo Off page Tips

Variancetv

Variancetv Virus

Remove Variancetv Virus

Noad remove Variancetv

How to remove Variancetv Virus

9xmovies

Download 9xmovies App

9xmovies hollywood movies download

Download bollywood movies

9xmovies bollywood movies download

Anime

Kissanime

Sites like Kissanime

Kissanime Website

Kissanime Alternatives

Best sites like Kissanime

Kisscartoon

Steven Universe

Kisscartoon Alternatives

Watchcartoononline

Watch cartoon Online

steven universe next episodes

Steven Universe Episodes

Steven Universe Kisscartoon

steven universe escapism

steven universe all episodes

Thanks for sharing this wonderful information if you need more information about DeMat account, insurance, mutual fund, please visit our websites.

ReplyDeleteBest Mutual Funds to Invest

Awesome and interesting article. Great things you've always shared with us. Thanks. Just continue composing this kind of post.

ReplyDeletevintage leather biker jacket mens

A great decision for your design needs! From our racer themed gathering we brought to you our Men's Biker Jacket for Men . Comprised of cotton, this coat has pockets on its outside and inside. It has long sleeves which suits your needs and solace. This coat has focal zipper attaching that makes it simple to wear. It has an ideal fitting with premium sewing that will without a doubt add a degree of class to your look.

ReplyDeleteFormal Leather Wear a classic choice for your fashion needs! From our military-themed collection we brought to you our Shearling Jackets.

ReplyDeleteAwesome and interesting article Great things you've always shared with us. Same day courier

ReplyDelete

ReplyDeleteDonate Ramadan Zakat to Muslims charity through Muslim Rose Welfare to help Muslim. Your Ramadan Donations can help those less fortunate.

Thanks for sharing this informative blog. Equity Tips

ReplyDeleteCheck out here a list of free best sports streaming sites. Watch live sports streaming online for free of cost. For more details must read here.

ReplyDeleteIs the Kissanime legal?

Kissanime website

amazing Article, Thanks for sharing!

ReplyDeleteTop 10 Best Casinos In Goa to Try Your Luck

We are offering Guest posting at reasonable price. Contact us here : https://www.writeyourpost.com/about-us/ for order now.

ReplyDeleteVery informative aricle about Value Investing ideas

ReplyDeleteFinancial investment. Thank you for sharing.

Wow I can say this is another extraordinary article of course of this blog. Bird Motorcycle Jacket In Vintage Coarse Grain Leather

ReplyDeleteI really thank you for sharing the blogs with us. I request you to keep blogging about intraday calls and sharing with us because it is really helpful.

ReplyDeleteThis is an awesome motivating article. I am practically satisfied with your great work

ReplyDeleteLeather Biker Jackets For Men

Unique cash for cars is one of the top companies in Gold Coast who pays top cash for cars up to $9,999 cash for cars gold coast

ReplyDeleteYou can open a account in Islamic bank account for this Mashreq Alislami is the best bank in UAE.

ReplyDeleteAmazing article, Thanks for sharing!

ReplyDeleteThe Ultimate Guide to SIP Investments

I want to invest in mutual fund, is it the right choice for me? And please also tell me which one is best?

ReplyDelete“Mudrabhandar”

Great article. Very important information shared. Keep posting such articles to guide people. Click here to see the top 10 LATEST BOLLYWOOD SONGS

ReplyDeleteThanks for sharing this amazing post.To know more about mutual fund services please visit our UTIITSL website offered by vakilsearch.

ReplyDeleteThanks for sharing this wonderful information if you need more information about DeMat account, insurance, mutual fund, please visit our website. NiveshMarket: Personal Finance and Investment Blog Debt Mutual Funds

ReplyDeleteGreat guide. It is really helpful. Thanks for sharing!

ReplyDeletehostinglive247

Superb blog. When I saw Jon’s email, I know the post will be good and I am surprised that you wrote it man!

ReplyDeleteWe are the best Share Market training academy in Chennai, offering best stock market trading and technical analysis training online & live classes. Enroll now for share market classes by today.for more details contact us: +91 95858 44338, +91 95669 77791

Freddie Mercury Concert Yellow Leather Jacket

ReplyDelete