What is Future? What is Nifty Futures ?

These

questions comes in the mind of those trader who are either newcomer in stock

market or want to come in stock market but do not know what it is actually

Nifty Future. But they have listen this word number of times.

So

as we know there is National Stock Exchange, one of the main stock exchange of

India. Most of the companies registered in this stock exchange and through this

stock exchange we are able to do transaction in these companies stock . We are

able to buy and sell the companies stock through our broker and broker

registered in stock exchange.

So

Index of National Stock Exchange known as Nifty. And the derivative contract of

Nifty 50 known as Nifty Future. Nifty is a portfolio of main 50 stocks and

according to movement of these stock, we see the up and down movement in Nifty

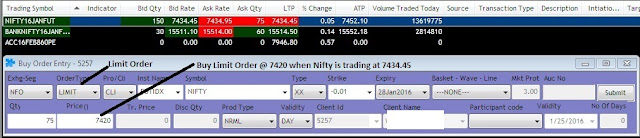

Futures terminologies: Let us understand various terms in the futures market with the help of quotes on Nifty futures from NSE:

Quotes

given on the NSE website for Nifty futures as on Jan 27, 2016

1.

Instrument type: Future Index

2.

Underlying asset: Nifty

3.

Expiry date: Jan 28, 2016

4.

Open price (in Rs.) : 7434

5.

High price (in Rs.) : 7473

6.

Low price (in Rs.) : 7415

7.

Closing price (in Rs.) : 7433.40

8.

Last Traded price (in Rs.) : 7433.40

9.

No of contracts traded : 209277

10.

Turnover in lakhs : 1167730.60

11.

Underlying value (in Rs.) : 7,437.75

12.

Open Interest: 12,215,625

Spot

Price: The

price at which an asset trades in the cash market. This is the underlying value

of Nifty on Jan 27, 2016 which is 7,437.75

Futures

Price: The

price of the futures contract in the futures market. The closing price of Nifty

in futures trading is Rs. 7433.40. Thus Rs. 7433.40 is the future price of

Nifty, on a closing basis.

Contract

Cycle: It

is a period over which a contract trades. On Jan 27, 2016, the maximum number

of index futures contracts is of 3 months contract cycle- the near month (Jan

2016), the next month (Feb 2016) and the far month (March 2016). Every futures

contract expires on last Thursday of respective month (in this case Jan 28, 2016).

And, a new contract (in this example - April 2016) is introduced on the trading

day following the expiry day of the near month contract (in this example – on

Jan 29, 2016).

Expiration

Day: The

day on which a derivative contract ceases to exist. It is last trading day of

the contract. The expiry date in the quotes given is Jan 28, 2016. It is the

last Thursday of the expiry month. If the last Thursday is a trading holiday,

the contracts expire on the previous trading day. On expiry date, all the contracts

are compulsorily settled. If a contract is to be continued then it must be

rolled to the near future contract. For a long position, this means selling the

expiring contract and buying the next contract. Both the sides of a roll over

should be executed at the same time. Currently, all equity derivatives

contracts (both on indices and individual stocks) on NSE are cash settled

whereas on BSE, derivative contracts on indices are cash settled while the

contracts on individual stocks are delivery settled.

Tick

Size: It

is minimum move allowed in the price quotations. Exchanges decide the tick

sizes on traded contracts as part of contract specification. Tick size for

Nifty futures is 5 paisa. Bid price is the price buyer is willing to pay and

ask price is the price seller is willing to sell.

Contract

Size and contract value: Futures contracts are traded in lots and to arrive

at the contract value we have to multiply the price with contract multiplier or

lot size or contract size. For Nifty 50, lot size is 75 . For individual

stocks, it varies from one stock to another. The lot size changes from time to

time. In the Nifty quotes given above, contract value would be equal to Nifty

Futures Price * Lot Size = 7433.40 * 75 = Rs. 5,57,505. Recently NSE has introduced

minimum contract size as Rs 5 Lakhs for any contracts

Basis:

The

difference between the spot price and the futures price is called basis. If the

futures price is greater than spot price, basis for the asset is negative.

Similarly, if the spot price is greater than futures price, basis for the asset

is positive. On Jan 27, 2016, spot price > future price thus basis for nifty

futures is positive i.e. (7,437.75-7433.40 = Rs. 4.35).

Importantly,

basis for one-month contract would be different from the basis for two or three

month contracts. Therefore, definition of basis is incomplete until we define

the basis vis-a-vis a futures contract i.e. basis for one month contract, two

months contract etc. It is also important to understand that the basis difference

between say one month and two months futures contract should essentially be

equal to the cost of carrying the underlying asset between first and second

month. Indeed, this is the fundamental of linking various futures and

underlying cash market prices together.

During

the life of the contract, the basis may become negative or positive, as there

is a movement in the futures price and spot price. Further, whatever the basis

is, positive or negative, it turns to zero at maturity of the futures contract

i.e. there should not be any difference between futures price and spot price at

the time of maturity/ expiry of contract. This happens because final settlement

of futures contracts on last trading day takes place at the closing price of

the underlying asset.

Cost

of Carry Cost

of Carry is the relationship between futures prices and spot prices. It

measures the storage cost (in commodity markets) plus the interest that is paid

to finance or ‘carry’ the asset till delivery less the income earned on the

asset during the holding period. For equity derivatives, carrying cost is the

interest paid to finance the purchase less (minus) dividend earned.

For

example, assume the share of ABC Ltd is trading at Rs. 100 in the cash market.

A person wishes to buy the share, but does not have money. In that case he

would have to borrow Rs. 100 at the rate of, say, 6% per annum. Suppose that he

holds this share for one year and in that year he expects the company to give

200% dividend on its face value of Rs. 1 i.e. dividend of Rs. 2. Thus his net

cost of carry = Interest paid – dividend received = 6 – 2 = Rs. 4. Therefore,

break even futures price for him should be Rs.104.

It

is important to note that cost of carry will be different for different

participants.

Margin

Account As

exchange guarantees the settlement of all the trades, to protect itself against

default by either counterparty, it charges various margins from brokers.

Brokers in turn charge margins from their customers. Brief about margins is as follows:

Initial

Margin The amount one needs to deposit in the margin account at the time

entering a futures contract is known as the initial margin.

Let us take an example - On Jan 27, 2016

a person decided to enter into a futures contract. He expects the market to go

up so he takes a long Nifty Futures position for 25th Feb 2016

expiry. On Jan 27, 2016 Nifty closes at 7433.40.

The

contract value = Nifty futures price * lot size = 7433.40 * 75 = Rs. 557,505.

Therefore,

Rs 557,505 is the contract value of one Nifty Future contract expiring on Feb

2016.

Assuming

according to the SPAN® calculation margin comes at around 5% of the contract

value as initial margin, the person has to pay him Rs. 27,875.25 as initial

margin. Both buyers and sellers pay initial margin, as there is an obligation

on both the parties to honour the contract.

The

initial margin is dependent on price movement of the underlying asset. As high

volatility assets carry more risk, exchange would charge higher initial margin

on them.

Exposure Margin: Time to Time

basis exchange releases a circular for exposure margin levied on Futures Index

& Futures Stock. For Index(s) exposure margin as on date 27 Jan 2016 is 3%

which means, both buyers and sellers pay exposure margin over and above Initial

margin. In our case it would be 557,505 *3% = 16,725.15

Mark to Market (MTM) In futures

market, while contracts have maturity of several months, profits and losses are

settled on day-to-day basis – called mark to market (MTM) settlement. The

exchange collects these margins (MTM margins) from the loss making participants

and pays to the gainers on day-to-day basis.

Let

us understand MTM with the help of the example. Suppose a person bought a

futures contract at the lowest price on Jan 27, 2016 at 7415. He paid an

initial margin of Rs. 27,875.25 & Exposure Margin of Rs 16725.15 as

calculated above. On the same day Nifty futures contract closes at 7433.40.

This means that he benefits due to the 18.4 points gain on Nifty futures

contract. Thus, his net gain is of Rs. 1,380

(18.4 * 75). This money will be credited to his account and next day the

position will start from 7433.40.

Open

Interest and Volumes Traded An open interest is the total number of

contracts outstanding (yet to be settled) for an underlying asset. The quotes

given above show us on Jan 27, 2016 Nifty futures have an open Interest of 12,215,625.

It is important to understand that number of long futures as well as number of

short futures is 12,215,625. This is because total number of long futures will

always be equal to total number of short futures. Only one side of contracts is

considered while calculating/ mentioning open interest. On Jan 25, 2016, the

open interest in Nifty futures was 15,204,900. This means that there is a

decrease of 2,989,275 in the open interest on Jan 27, 2016. The level of open

interest indicates depth in the market.

Volumes

traded give us an idea about the market activity with regards to specific

contract over a given period – volume over a day, over a week or month or over

entire life of the contract.

Contract

Specifications Contract

specifications include the salient features of a derivative contract like

contract maturity, contract multiplier also referred to as lot size, contract

size, tick size etc. An example contract specification is given below: NSE’s

Nifty 50 Index Futures Contracts

|

|

Underlying

index

|

NIFTY

50

|

Contract

Multiplier (Lot size)

|

50

|

Tick

size or minimum price difference

|

0.05

index point (i.e., Re 0.05 or 5 paise)

|

Last

trading day/ Expiration day

|

Last

Thursday of the expiration month. If it happens to be a holiday, the contract

will expire on the previous business day.

|

Contract

months

|

3

contracts of 1, 2 and 3 month’s maturity. At the expiry of the nearest month

contract, a new contract with 3 months maturity will start. Thus, at any

point of time, there will be 3 contracts available for trading.

|

Daily

settlement price

|

Settlement

price of the respective futures contract.

|

Final

settlement price

|

Settlement

price of the cash index on the expiry date of the futures contract.

|

Equities related article :

What is Power of Attorney in Online Trading?

Futures & Options related article :