Market Order vs Limit Order vs Stop Loss Order

Market Orders

A market order allows you buy or sell a stock at the prevailing market price. When you place an order during normal market hours (9:15 AM to 3.30 PM), a market order typically executes within seconds. There are certain brokers in India who allows After Market Order, When you place a aftermarket order during non-market hours, Trading System automatically moves the trade when market opens, so the order executes as soon as possible.

Limit Orders

|

| Market Order |

Limit Orders

A limit order allows you to specify the maximum amount you are willing to pay for a security (when you buy) or the minimum amount you are willing receive for a security (when you sell).

Examples:

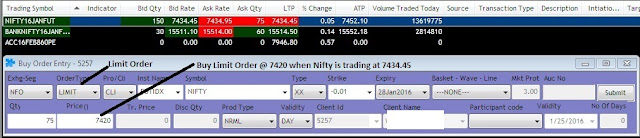

- Buy Limit Orders: Let's say you want to buy NIFTY Jan Future for Rs 7420.00 or less and the current market price is Rs 7435. You can enter a limit price at Rs 7420, and trading system will only NIFTY Futures if it trades at Rs 7420 or less. If NIfty Futures trades above the limit price, the buy order will not execute. Typically, the limit price for a buy order is placed at or below the current Ask price

Simply speaking you want to buy at a lower price than market price and only and if there is a seller at your price , order will get executed else it won’t

Simply speaking you want to buy at a lower price than market price and only and if there is a seller at your price , order will get executed else it won’t- Sell Limit Orders: Let's say you want to sell NIFTY Futures at 7450 and Nifty is trading at 7435, in this case you can enter a limit price at Rs 7450, and trading engine will only sell the futures if it trades at 7450 or more. If the security trades below the limit price, the sell order will not execute. Typically, the limit price for a sell order is placed at or above the current Bid price.

Stop-Loss Orders

Stop-Loss Orders

A stop-loss order can help you limit your losses. If the market price reaches or crosses through the Stop price, your order is sent to the exchange as a market order.

Example:

To clarify further below image is an example for Nifty Futures

- Sell Stop-Loss: When you place a Sell Stop-Loss order, you create a "floor" for your position. Let's say you have bought Nifty Futures 1 Lot at Rs 7500 and you'd like to sell i.e (Target Price) at Rs 7550 or book loss if the price reaches Rs 7450.00. You can place a Stop-Loss order and enter a Stop Price of Rs 7550 & Rs 7450 respectively for Target Price & Stop Loss. If NIFTY reaches Rs 7550 or 7450 , the order triggers and becomes a market order. You'll get the current price available for the security under the prevailing market conditions. *Remember you have to manually remove other stop loss order if anyone of them is executed

|

| Sell Stop Loss Order |

- Buy Stop-Loss: When you place a Buy Stop-Loss order, you create a "ceiling" for your position. Let's say you shorted a Nifty Futures 1 Lot at Rs 7500. You'd like to buy i.e (Target Price) at Rs 7450 or book loss if the price reaches Rs 7550.00. You can place a Stop-Loss order and enter a Stop Price of Rs 7540 & Rs 7550 respectively for Target Price & Stop Loss. If the contract price reaches 7450 or 7550, the order triggers and becomes a market order. You'll get the current price available for the security under the prevailing market conditions.

|

| Buy Stop Loss Order |

Criteria:

- Sell Orders: The Stop Price must be entered at least 0.05 below the current Bid Price in Indian Market

- Buy Orders: The Stop Price must be entered at least 0.05 above the current Ask Price in Indian Market

Problem with Stop Loss Order , Please check the below example

You Bought Nifty Futures at Rs 7500 – Margin Levied Rs 50000/-

You Put a Stop Loss Order for Profit booking at Rs 7550 – Margin Levied Rs 0,

As the Nifty Futures at this point of time haven’t reached 7550 and to safe guard yourself you are entering a Stop Loss order at Rs 7450, in this case the RMS of Trading engine would ask for another Rs 50000/- as Margin Requirement because according to RMS there would anytime remain 1 pending order of 1 Lot of Naked Position of NIFTY

This problem is eradicated in bracket order which is mentioned below

Bracket Order

Customer places a bracket order such that the parent order (LEG1) is placed with two cover order of the same quantity, ie Book Profit trigger Order (Exit at target)(LEG2) and Loss Exit Order (LEG3).

The parent order (LEG1) is immediately send to exchange, were in book Profit trigger order (LEG2) and Loss Exit Order (LEG3) remains in the trading system

Once the parent order (LEG1) is executed, the book Profit trigger Order (LEG2) and Loss Exit Order (LEG3) are considered for viable condition, ie the condition to check LEG2 and LEG3 touching the market rate.

Once viable condition favours, either of the cover order, ie Leg1 or Leg2 is generated and placed to exchange for squaring off the position.

Here is an example which might help you to understand how stock market bracketed orders work. If you place a buy bracketed order for 1 Lot of Nifty Futures at Rs 7500 [LEG 1], you can then set a sell stop order at Rs 7450 [LEG 3] and a sell limit of Rs 7550 [LEG 2] in a single order. This means that for a single order you can input 3 details , Buy or Sell Price, Target Price & Stop Loss Price. In this example Nifty Lot will be purchased at Rs 7500 [LEG 1] will be sold if they drop to 7450 [LEG3] or rise to 7550 [LEG2] . And there won’t be any pending order in exchange resulting in faster execution of error free trades

In case if you have any doubt or clarifications please let me know in comment section

Equities related article :

What is Power of Attorney in Online Trading?

Futures & Options related article :

Opti Farms Keto supports healthy immunity and drives to reduce overweight size

ReplyDeleteof the body by eliminating bad cholesterol level. It improves ketosis that restricts

fat accumulation inside the body and makes best utilized as energy boost. The supplement

is one of the best selling product over the internet that makes you slim and stylish

Opti Farms Keto

Smart Blood Sugar is another wellbeing and wellbeing guide that guarantees to show individuals another “lifestyle” to normally improve their glucose, get in shape, and keep up their wellbeing and vitality. Smart Blood Sugar is claimed to immediately reduce your risk of diabetes, without drugs or injections. Kindly Visit on http://investkiyakya.blogspot.com/2016/01/different-types-of-orders-in-stock-market.html

ReplyDeletehttps://www.drozus.com

ReplyDeleteWhy people still use to read news papers when in this technological world all is accessible on web?

SkinGenix Tag Remover Cream is a skin tag and mole remover formula claims to helps users to remove the skin tags and moles naturally. And also claims to be a 100% natural cream, but there is no complete ingredients list found. SkinGenix Face Cream claims to work to enhance skin health and remove the skin tags quickly. And for this product supplies vitamins and minerals and some other essential elements to provide clear skin. Visit On http://www.theapexhealth.com/skingenix-skin-tag-remover-reviews-by-experts-on-skin-tags/

ReplyDeleteThank for your valuable information

ReplyDeleteBalkrishna Industries Ltd

Balkrishna Industries Ltd

ITC Ltd

Tata Steel Ltd