"Sizing Up Mutual Funds"

Small and mid-sized funds have performed better than their bigger counterparts in the past few years. Does size of the mutual fund really matter? You decide

World renowned fund manager Peter Lynch says, “My biggest

disadvantage is size. The bigger the equity fund, the harder

it gets to outperform the competition.” This saying holds true

even for the Indian mutual fund Industry.

A large chunk of money is invested in ‘big corpus’ schemes by

retail investors. Unfortunately, such schemes have failed to deliver decent returns in the past few years.

On the other hand, newer schemes with limited size have been able to outperform and give huge returns over the benchmark indices. There is a perception in your mind that larger the fund size, better the performance of the scheme.

But in fund management, its gets more and more difficult to manage large-sized funds.

Must Read : Best 3 Large Cap Equity Mutual Funds for SIP

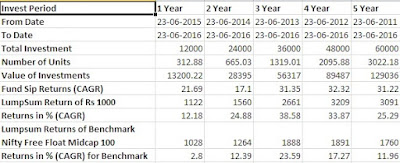

Systematic Investment Plan (SIP) is a very successful phenomenon in the Indian mutual fund industry with a large number of investors entering mutual funds only through SIPs. So, whenever the fund receives money - whether it is weekly, monthly or quarterly, the fund manager needs to find opportunities in the market. It

becomes even more difficult for small and mid-sized funds to look for investing ideas as liquidity plays a very significant role in such funds and uncertain market conditions.

Large-sized funds can create problems for fund managers not only

in the mid and small-cap categories but also in the multi-cap and large-cap categories. The biggest issue any fund manager faces while managing large-sized mutual funds is that of liquidity and the availability of enough stock opportunities in such volatile markets.

To cite an example, many large-sized funds like HDFC Top 200, Franklin India Bluechip and DSP BlackRock Top 100 have struggled to outperform the market in the past few years.

Having said that these are funds that have seen different market cycles and superior past performance and can bounce back sooner than later.

Must Read : Best 3 Equity Midcap Funds Churning Money for Investors

But if we look at some other schemes with small corpus like Mirae Asset Emerging Bluechip Fund, SBI Magnum Midcap and Franklin India Smaller Companies Fund , we find that these funds with less than 3000 crore of the total corpus have delivered huge returns in the last few years. Many such funds have given returns in the range of 20% to 25% in the last one year.

When it comes to fund management,the size of the fund becomes a big hindrance to sustain its positive returns on a continuous basis. For example, if a fund manager runs a small fund with a corpus of 3000 crore, he can invest in any stock he likes.

Suppose he invests in stock‘ABC’ and if he is bullish on that

particular stock, he can buy up to 10% in the fund. If his call goes right, then the fund might deliver outstanding returns and vice versa.

But supposing the fund manager manages 10,000 crore funds, he

cannot have 10% in any single stock, which might come to 1,000 crore. Such a strategy could backfire in a big way if that stock does not give the fund manager the desired result. Even if the fund manager takes a small exposure in that stock, it might not have an overall impact on the fund.

Must Read : Mutual Fund Versus ULIP

It is a known fact that whenever the funds get bigger, the universe of stocks gets smaller. Fund managers come in a situation where they can invest in select stocks out of hundreds. The competition gets fierce and it becomes more and more difficult to outperform the main benchmark indices.

Many funds in India have performed very well in the past few years and once such funds get popular and start delivering positive returns on a continuous basis, they find more and more investors coming into their fold. This is where the problem of underperformance begins.

Globally we have seen how many funds became too large to handle; either they were turned into close-ended funds or they stopped taking in fresh investments. Even in India, IDFC Mutual Fund is one such fund house, which does not allow lump sum investments in their IDFC Premier Equity scheme. However,

investors can invest through SIPs.

Must Read : Liquid Funds Better alternative to Savings Bank A/c

Many times when a fund becomes big, the fund manager sticks to

picking up stocks in line with the benchmark indices in order to take less risk. Many argue that with a larger corpus, the fund becomes ‘benchmark-linked funds’. This, in turn, would give the investor returns in line with the benchmark and take it high compared to index funds.

Of the many fund managers, some prefer managing small funds because it allows them to enter or exit any particular stock with ease, which becomes almost impossible in big-sized funds. However, one should never go by huge returns by small funds because few winning stocks in the portfolio could have a large impact on the fund’s performance.

New funds do not have a long track record, but there are many investors who could be lured to purchase a fund managed by a new manager. Funds are less diversified in some cases and the poor performance of one stock will have a large negative impact on

the overall portfolio.

Must Read : Risk Management for you in Broking House

It is always difficult to predict how and when big-sized funds can go wrong in their investment strategies. But it is always seen that investors can find the schemes that have turned too large and not manageable when the fund manager tried to change his investment strategy and give returns in line or below the benchmark.

However such problem arises only in equity funds. But, with debt funds,exchange traded funds (ETFs) or index funds, size of the fund has nothing to do with returns.

If you want to look at the mutual fund size and their benefits or

disadvantages, you may consider these three options. Firstly, their total corpus, whether the funds’ size is shrinking month-on-month; then you should realize that the fund manager is not doing enough work and, hence, investors are moving away from the fund. Secondly,you should always invest according to your investment approach. If you are risk takers and want to invest from a long-term perspective, you should invest in mid and small-cap funds rather than diversified funds.

Lastly, many fund managers like to hold cash, thinking that they might invest when the markets correct. Sometimes the call might go

absolutely right, but on many occasions mutual fund managers are

known to have missed the rally as we have seen after the 2009 crises in the Indian markets.

Must Read : What are Monthly Income Plans (MIP) ?

IN A NUTSHELL

The main reason why small mutual funds turn big is because of their historical performances which attracts more and more investors.

But in the financial markets past performance does not decide the

performance of the future.

Yet, there is no golden rule that you should stay away from big corpus funds or invest only in small-sized funds.

There is no direct correlation between the size of the fund and its

performance, but investors should not rush and invest only because ‘bigger is better’.

The right way to select a fund is to look at funds’ historical returns, their charges, their star ratings and whether or not they rank on the top in quartile of their category.

Must Read : How to Select Mutual Funds for Portfolio

It is not easy to give good returns year on year. There might be times or even years when funds might under perform. One should not blindly follow them. If you want to seriously invest in mutual funds for your future prospects, then you can look at various schemes, which are top performers, although they have a

small corpus.

It is up to you to make sure that funds match your goals and if they are unable to do that, they can switch to other asset classes.

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

About the author

Vipul is a software sales professional for Asset Management Companies, Pension Fund and Stock Brokers from last 16 years.

Vipul believes that the amount of financial information flowing our way is probably 10 times more than what it used to be 15 to 20 years back due to the advent of newer forms of communication.

All this information is creating an information overload in the minds of individuals resulting in analysis paralysis and he helps them select the right decision while creating a Goal based financial plan.

In case if you need a Financial Plan please connect to him on vipuls1979@gmail.com

Mutual Funds & Insurance Related Articles :-

Benefits of SIP

What is SWP in mutual Funds

Best 3 Large Cap Mutual Funds for SIP in 2016

Best 3 Midcap Mutual Funds for SIP in 2016

Why you should not buy ULIP

How to Select Mutual Fund for Portfolio

Liquid Funds are better alternative than Savings Bank account

What is FMP in Mutual Funds

Complete Guide on Monthly Income Plans

Complete Guide on Credit Opportunities Fund

How to Save Tax using Equity Linked Savings Scheme

How to Budget Your Money

How Much Insurance Do You Really Need

Why Should you buy Term Insurance Upto 60 Years

5 Must Have Insurance Policies for Women

Equities related article :

What is Power of Attorney in Online Trading?

Futures & Options related article :

Bull Put Spread

In case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

The Article is only for information purposes and Vipul Shah (https://investkiyakya.blogspot.com)

is not providing any professional/investment advice through it. The

article does not constitute or is not intended to constitute an offer to

buy or sell, or a solicitation to an offer to buy or sell financial

products, units or securities. https://investkiyakya.blogspot.com disclaims

warranty of any kind, whether express or implied, as to any

matter/content contained in this article, including without limitation

the implied warranties of merchantability and fitness for a particular

purpose. https://investkiyakya.blogspot.com and

its subsidiaries / affiliates / sponsors / trustee or their officers,

employees, personnel, directors will not be responsible for any

direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the contents of this guide. Use of this article is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. https://investkiyakya.blogspot.com does

not warrant completeness or accuracy of any information published in

this guide. All intellectual property rights emerging from this article

are and shall remain with https://investkiyakya.blogspot.com.

This article is for your personal use and you shall not resell, copy,

or redistribute this article , or use it for any commercial purpose. All

names and situations depicted in the article are purely fictional and

serve the purpose of illustration only. Any resemblance between the

illustrations and any persons living or dead is purely coincidental.