Best 3 Equity Midcap Mutual Fund to Invest via SIP in 2016

The mid and small cap fund category is indeed the most exciting of the lot. It adds a lot of zing to the portfolio and is capable of offering above-average returns when the markets are in uptrend. on the other hand, funds in this category are more prone to volatility as mid and small cap companies are hit harder when markets tank.While there are many midcap funds available in the market ,it becomes practically difficult for investor to select funds to invest.

Apart from that many website and blogger provide an option like top 10 funds to invest as title header and after reading the post investor like you gets more confused. In order to overcome this confusion I only provide 3 best funds and i am invested in 2 of them mentioned below.

Midcap funds are risky and it is recommended for investor you are willing to take risk

Let us go ahead with the funds selection method

- Alpha Ratio

- Rolling Returns calculation for 3 years

- SIP Returns

- Funds in existence from last 5 years

- CIRSIL, Morning Star & Value Research Ratings

Must Read : Why Real Estate is and always was a Dull Investment

Below is the list of 3 best midcap funds

Below is the list of 3 best midcap funds

#1 : Mirae Asset Emerging Bluechip Fund

Mirae Asset Emerging Bluechip Fund (MAEBF) gives investors the opportunity to participate in the growth of emerging companies which have the potential to be tomorrow's large caps/Bluechip companies. This fund invest in companies which are not part of the top 100 stocks by market capitalization and have market capitalization of at least 100 Crores at the time of investment.

|

|

| 3 Years Rolling Returns Compared to Benchmark |

Rs 1,000 invested in the fund on 23/06/2011 would have grown to around Rs 2935 (compounded annualised return of 23.99 per cent) as on June 24 2016. A similar investment in the benchmark NIfty Free Float Midcap 100 would have grown to Rs 1738 (11.67 per cent).

Rolling returns for 3 years clearly indicates that fund has outperformed to benchmark fund and provided a return of more than 15% CAGR which makes this fund on top contender to invest in midcap

The fund has performed well on a risk-adjusted basis as well. Sharpe ratio (which measures the excess returns over the risk-free rate per unit of risk) of the fund is at 1.54 and alpha of 19.93

This is a kind of fund which in-spite of high returns possess low risk as beta is .94

Must Read : Best 3 Large Cap Mutual Fund to Invest in SIP

#2 : SBI Magnum Midcap Fund

Objective of this fund is to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme by investing predominantly in a well diversified basket of equity stocks of Midcap companies and believe me this fund is doing exactly as per the objective.

This fund is managed by Sohini Andani who also manages SBI Bluechip Fund which is ranked as #1 by CRISIL

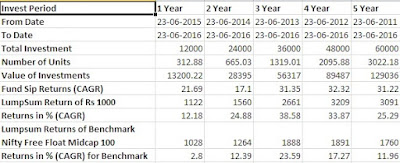

Let us see the returns for SIP for last 5 years

Performance : If you had invested via SIP on 23/06/2011 as of now your investment would have 123030 , twice the money you invested via sip with a CAGR of 29.2%

Rolling

returns for 3 years clearly indicates that fund has outperformed to

benchmark fund and provided a return of more than 15% CAGR which makes

this fund as my best selection for midcap

Must Read : If you have a slightly higher risk appetite and investment horizon of 18 to 24 months you can consider Credit Opportunities Fund

#3 : Franklin India Smaller Companies Fund

If you are seeking exposure to mid-cap stocks with steady and consistent performance can consider the Franklin India Smaller Companies Fund. It will neither balloon during the bull market, nor will it under-perform during the bear market.

Although the fund invests primarily in high quality mid-cap stocks, it does have an exposure to large-cap stocks, which can offer some cushioning during turbulent times.

Rs 1,000 invested in the fund on 23/06/2011 would have grown to around Rs 3022.18 (compounded annualized return of 25.29 per cent) as on June 24. A similar investment in the benchmark would have grown to Rs 1760 (11.96 per cent).

A monthly systematic investment plan (SIP) of Rs 1,000 for a period of five years (on a principal of Rs 60,000) would grow to around Rs 129036, delivering an annualized return of 31.22 per cent.

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

Mutual Funds & Insurance Related Articles :-

Benefits of SIP

What is SWP in mutual Funds

Best 3 Mutual Funds for SIP in 2016

Why you should not buy ULIP

How to Select Mutual Fund for Portfolio

Liquid Funds are better alternative than Savings Bank account

What is FMP in Mutual Funds

Complete Guide on Monthly Income Plans

Complete Guide on Credit Opportunities Fund

How to Save Tax using Equity Linked Savings Scheme

How to Budget Your Money

How Much Insurance Do You Really Need

Why Should you buy Term Insurance Upto 60 Years

5 Must Have Insurance Policies for Women

What is Power of Attorney in Online Trading?

Bull Put Spread

In case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

Must Read : If you have a slightly higher risk appetite and investment horizon of 18 to 24 months you can consider Credit Opportunities Fund

#3 : Franklin India Smaller Companies Fund

If you are seeking exposure to mid-cap stocks with steady and consistent performance can consider the Franklin India Smaller Companies Fund. It will neither balloon during the bull market, nor will it under-perform during the bear market.

Although the fund invests primarily in high quality mid-cap stocks, it does have an exposure to large-cap stocks, which can offer some cushioning during turbulent times.

| |

| SIP returns for last 5 years |

|

| Rolling Returns for 3 year |

Rs 1,000 invested in the fund on 23/06/2011 would have grown to around Rs 3022.18 (compounded annualized return of 25.29 per cent) as on June 24. A similar investment in the benchmark would have grown to Rs 1760 (11.96 per cent).

A monthly systematic investment plan (SIP) of Rs 1,000 for a period of five years (on a principal of Rs 60,000) would grow to around Rs 129036, delivering an annualized return of 31.22 per cent.

PPS: If you think this page and blog will be useful to any of your friends please spread the word. A good way to start is to share this page on your social circle using floating social share bar on the left

Mutual Funds & Insurance Related Articles :-

Benefits of SIP

What is SWP in mutual Funds

Best 3 Mutual Funds for SIP in 2016

Why you should not buy ULIP

How to Select Mutual Fund for Portfolio

Liquid Funds are better alternative than Savings Bank account

What is FMP in Mutual Funds

Complete Guide on Monthly Income Plans

Complete Guide on Credit Opportunities Fund

How to Save Tax using Equity Linked Savings Scheme

How to Budget Your Money

How Much Insurance Do You Really Need

Why Should you buy Term Insurance Upto 60 Years

5 Must Have Insurance Policies for Women

Equities related article :

What is Power of Attorney in Online Trading?

Futures & Options related article :

Bull Put Spread

In case of any further explanation you can reach me on vipuls1979@gmail.com or tweet me @vipuls1979

Disclaimer :-

The Article is only for information purposes and Vipul Shah (https://investkiyakya.blogspot.com)

is not providing any professional/investment advice through it. The

article does not constitute or is not intended to constitute an offer to

buy or sell, or a solicitation to an offer to buy or sell financial

products, units or securities. https://investkiyakya.blogspot.com disclaims

warranty of any kind, whether express or implied, as to any

matter/content contained in this article, including without limitation

the implied warranties of merchantability and fitness for a particular

purpose. https://investkiyakya.blogspot.com and

its subsidiaries / affiliates / sponsors / trustee or their officers,

employees, personnel, directors will not be responsible for any

direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the contents of this guide. Use of this article is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. https://investkiyakya.blogspot.com does

not warrant completeness or accuracy of any information published in

this guide. All intellectual property rights emerging from this article

are and shall remain with https://investkiyakya.blogspot.com.

This article is for your personal use and you shall not resell, copy,

or redistribute this article , or use it for any commercial purpose. All

names and situations depicted in the article are purely fictional and

serve the purpose of illustration only. Any resemblance between the

illustrations and any persons living or dead is purely coincidental.

Visit for the best Mutual Fund Advisor and Companies at Meetplutus.

ReplyDeletemutual fund advisor delhi

Thank for your valuable information. stock investor is a stock related website which provides day to day information of the stock market.

ReplyDeleteUnited Breweries Ltd

Karur Vysya Bank Ltd

Excellent blog with information and if you want to enjoy the most famous tourist places in India. Book the perfect journey in India which completes your travel needs to do

ReplyDeleteGolden Triangle Tour Package

Delhi Tour Packages

Agra Tour Packages

North India Tour

Taj Mahal Tour Packages

Golden Triangle Tour Packages

Delhi to Agra Tour

Same Day Agra Tour by train

Agra One Day Tour Package

perde modelleri

ReplyDeletesms onay

mobil ödeme bozdurma

Nft nasil alinir

Ankara Evden Eve Nakliyat

trafik sigortası

dedektör

web sitesi kurma

aşk kitapları

smm panel

ReplyDeletesmm panel

iş ilanları

İnstagram takipçi satın al

hirdavatciburada.com

beyazesyateknikservisi.com.tr

SERVİS

jeton hilesi indir

maltepe lg klima servisi

ReplyDeletekadıköy lg klima servisi

tuzla daikin klima servisi

çekmeköy toshiba klima servisi

ataşehir toshiba klima servisi

çekmeköy beko klima servisi

ataşehir beko klima servisi

kadıköy bosch klima servisi

maltepe arçelik klima servisi

"instagram takipçi satın al

ReplyDeleteinstagram beğeni satın al

instagram takipçi hilesi

instagram beğeni hilesi

tiktok takipçi satın al

youtube abone satın al

twitter takipçi satın al"

Same Day Taj Mahal Tour By Car | Same Day Agra Tour By Car

ReplyDeleteExcellent blog with information Thanks For Sharing Golden Triangle Explorer Tours

ReplyDeletesuperb amazing, thanks for sharing,itinerary/golden-triangle-explorer-tour-5-days">5 Days Golden Triangle Tour

ReplyDelete